Paying for things in Madagascar isn’t as straightforward as in many other countries. Here’s how to get your hands on fat stacks of Malagasy Ariary, how to use the mobile money apps in the country, and how to identify when people are quoting prices in Malagasy Franc (†2005). Using money in Madagascar is very intertwined with having a Malagasy SIM card, so check out that article as well.

Contents

- 1 Intro to The Ariary—Paper Money Only

- 2 Costs and Dual Pricing

- 3 Communicating Prices with Malagasy People

- 4 Using ATMs in Madagascar

- 5 Paying by Card in Madagascar

- 6 Mobile Money Services in Madagascar

- 7 Any other questions? Leave a comment below

- 8 Did I save you some trouble? Consider buying me baobab juice!

- 9 Sharing this article is a good deed

Intro to The Ariary—Paper Money Only

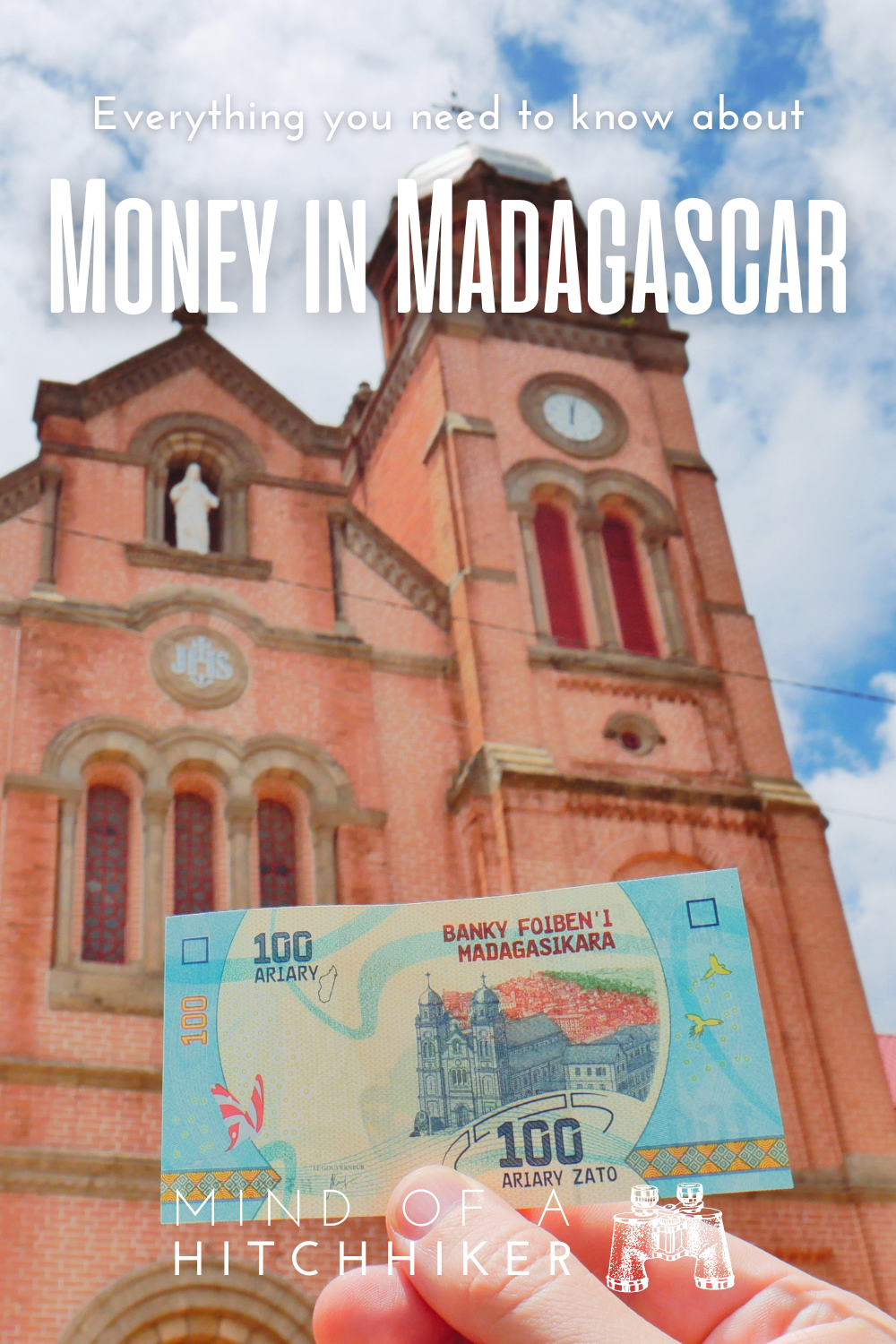

The Malagasy Ariary has been the official currency of Madagascar since 2005. Unlike Dollars or Francs, no other currency in the world goes by the name ‘Ariary’. So you can calmly leave out the ‘Malagasy’ or ‘Malgache‘ qualifier before mentioning the currency.

The smallest denomination in 2023 is the 100 Ariary banknote. As of publishing, that’s worth €0.02 or US$0.02. Though coins used to be in circulation, they aren’t used nowadays. So the Ariary is a paper currency only. There are a total of eight paper bills, of the following denominations: 100, 200, 500, 1.000, 2.000, 5.000, 10.000, and 20.000. Just like the Euro, the size of the banknote goes up along with its value.

The largest banknote of 20.000 Ariary is only worth €4.12 or US$4.42. This means that as a foreigner paying the foreigner rates and staying at more high-end accommodation, you’ll likely be traveling around Madagascar with large stacks of banknotes and a wallet that can barely still fold.

Costs and Dual Pricing

Madagascar is one of the poorest countries on Earth. For (most) foreigners, basic goods such as local food are very cheap. But everything geared towards foreigners is unaffordable for most locals. The price of accommodation has a large range depending on the location and level of service. The cost of transportation depends completely on the mode, from taxi brousse to rental car with driver. And for food, it’s most of the time quite cheap even if you don’t eat at local places. You can spend as little as 2.000 Ariary for a local meal, 20.000 for a meal at a middle-class restaurant, and more than 35.000 Ariary for a meal that won’t satisfy you at a resort where they know you can’t eat elsewhere.

All public museums and nature reserves in Madagascar apply dual pricing between locals and foreigners. If paying more than double makes you big mad, don’t travel to Madagascar. For example, the Madagascar Photography Museum in Antananarivo will cost you 20.000 Ariary to enter, while locals pay 8.000 Ariary. At the Rova of Ambohimanga, foreigners pay 10.000 Ariary and locals 400 Ariary. But in the privately-owned Lemurs Park, it’s 60.000 Ariary for everyone. We found all these prices still quite reasonable and don’t see a reason to compare ourselves with the locals.

Communicating Prices with Malagasy People

Unless you’re learning Malagasy, most of the time people will quote prices to you in French (or English). When you’re buying, for example, mangoes, people might quote the price as follows:

“C’est deux mille Ariary” (It’s two thousand Ariary)

If Malagasy people are talking among themselves about the price, it’s quite easy to recognize the word “Ariary”, which they often pronounce as Ar-yar.

Using French numbers is quite annoying when the number gets really large because they use a base-20 or vigesimal system. For example, 96.000 Ariary is “Quatre-vingt seize mille Ariary“. If French numbers aren’t your strong suit, you can grab your phone to write down the number you think is quoted or ask them to write it down if you think people can read and write.

Ariary, abbreviated to Ar, is usually written after the number. For example ‘350 Ar’.

Recognizing when people quote in the old Malagasy Franc (FMG)

The literacy rate of Madagascar isn’t very high, but it’s been improving in recent decades. You can imagine how changing the currency from Franc Malgache (abbreviated as FGM) to Ariary back in 2005 was difficult and painful when a large portion of the population can’t read the numbers on the bills. The exchange rate is 5 FGM for 1 Ariary.

Though it has been 17 years since the adoption of the Ariary, market vendors still sometimes quote the prices in Malagasy Franc. You won’t run into this problem with people who regularly deal with foreigners. But if something feels five times more expensive than it should be, your spidey sense is probably right.

When people quote prices in Euros, ask them what it is in Ariary

When booking a private vehicle with a driver to travel from city A to city B, people often quote the price in Euros. That’s because the far majority of tourists to Madagascar are French. These people often pay their entire Malagasy holiday in Euros without ever touching an Ariary. Don’t be like them. Here’s why: people often use the older exchange rate between Euros and Ariary. Or they charge more for paying in Euros. Depends on how you look at it.

When booking a car from Antsirabe to Morondava, the potential drivers quoted €350 for the ride in a 4×4 Starex vehicle. Jonas asked for the Ariary price, and the guy said it was 1.300.000 Ariary, which is €1 = 3.700 Ariary. But at that time, the banks were giving us €1 = 4.400 Ariary, making the price €295. There were still a lot of back-and-forths on which type of vehicle before we finally agreed on things. Moral of the story: it was 15% cheaper to pay in Ariary.

Also, we just don’t have Euros.

Using ATMs in Madagascar

ATMs aren’t everywhere in the country and they’re not always well-stocked. That’s why you should always pre-plan how much cash to get from an ATM. Our favorite bank to use is the BNI (Banque Nationale d’Investissement) because it has no fees. The other bank without fees is the Mauritian MCB (Mauritius Commercial Bank – which we’ve used at the airport) and the BMOI (Banque Malgache de L’ocean Indien – which we’ve never used). Here’s a map of all BNI offices and ATMs in Madagascar. You can see there are huge gaps where there are just no financial services. Most banks tend to cluster in one single part of town.

The maximum amount of bills you can get out of the ATM in one transaction is 40 banknotes. So the maximum amount of cash you can get in one go is 40 × 20.000 = 800.000 Ariary, or €165 or US$177. As you can see from the example of a long-distance car ride, it sounds like a lot but isn’t. Especially because you haven’t even paid for your accommodation or activities in the next village without a single bank branch.

Depending on your bank card, your amount of ATM transactions will be limited. Doing three transactions a day should usually be fine, which makes the total you can get in a day 2.400.000 Ariary, or €494 or US$531. But if the ATM only has banknotes of 10.000 Ariary or less in stock, you won’t even get that amount of money out. Madagascar isn’t a country for people who wing it. Prepare things in advance.

All ATMs accept MasterCard and Visa in Madagascar, both debit and credit cards.

Pro tip: take off your hat when using the ATM. Otherwise, an angry guard will come by and say stuff in French (Quelle horreur!) to enforce the dress code.

Paying by Card in Madagascar

This is uncommon and can only be done at better hotels, restaurants, and supermarkets. It’s also not possible to pay by card when a good hotel is remote. Sometimes you can only pay by card when the boss is present. And lastly, it sometimes doesn’t work temporarily when the internet connection is unstable or gone. Never assume you can pay by card, always have a Plan B. One valid alternative that doesn’t make you dish out all your precious banknotes is by paying in mobile money, more on that below.

If it works to pay by card in Madagascar, it might work with only Visa or only MasterCard. AmericanExpress is unheard of.

The place you’re paying at might apply a surcharge when paying by card. Ask if it’s the same price in cash. The surcharge can be as high as 5%.

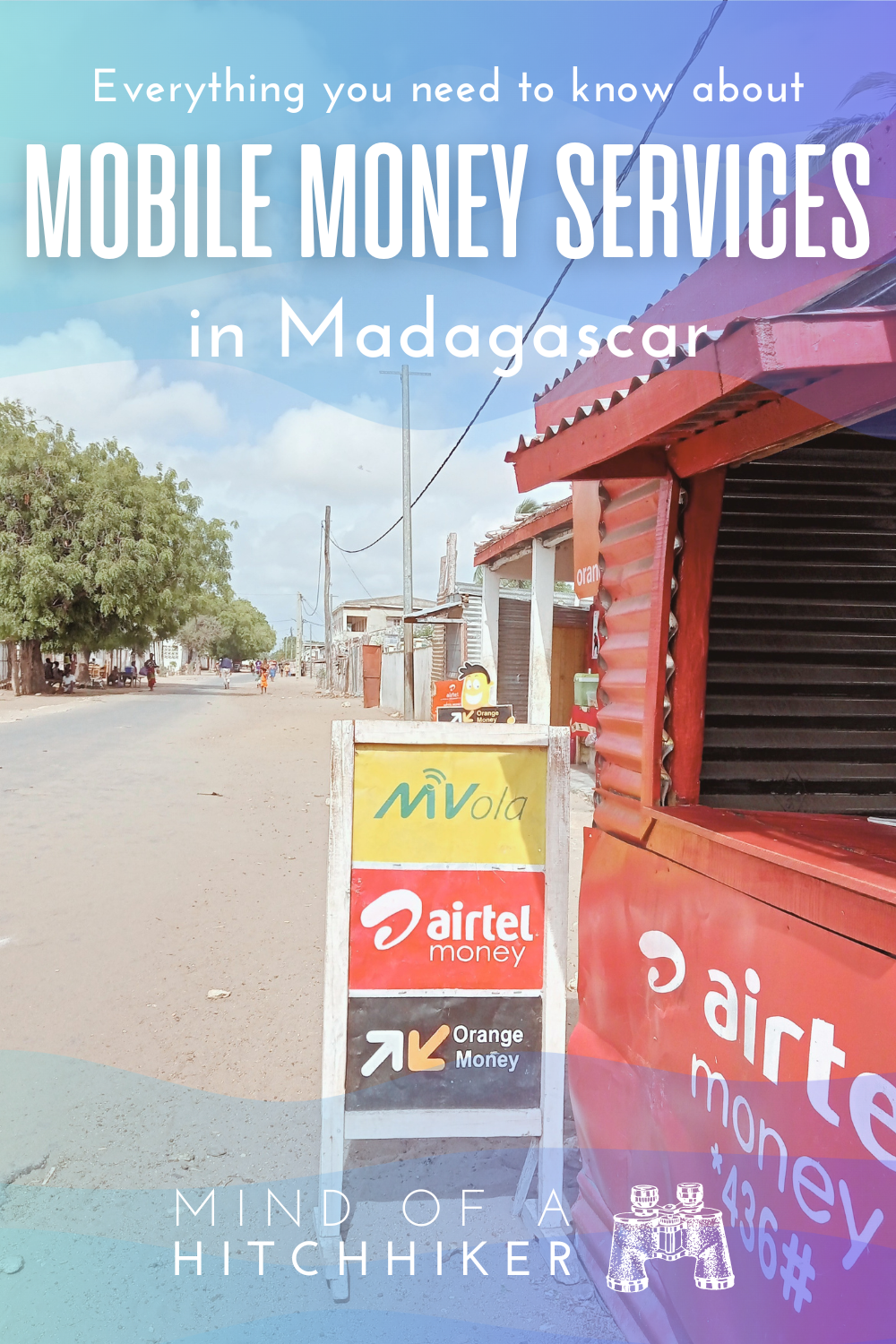

Mobile Money Services in Madagascar

One way to bypass the ATM issues and send money digitally is by having a local Malagasy SIM card. When you buy a local SIM card, such as Orange, Telma, or Airtel and the sign-up goes well, you’re automatically subscribed to their mobile money service. Orange has Orange Money, Airtel has Airtel Money, and Telma has – you guessed it – MVola. You’ll see the logos of these mobile money services everywhere in Madagascar.

Because of the aforementioned low literacy rate, it’s very logical that many Malagasy have a mobile phone and local SIM card but not a bank account. Except for owning an ID card and managing to scribble down something that could be a signature, it’s not necessary to need to read or write anything else to obtain a SIM. Many people own old mobile phones (aka ‘dumbphone’ or ‘feature phone’) instead of smartphones, not only because they’re more affordable. They have the user-friendly interface of the speed dial (if you remember those days). Many providers also have a lot of spoken menus for illiterate people to do stuff and it’s common for Malagasy people to give their phones to the nearest literate person to help them do stuff.

Now back to the mobile money services. All three companies offer this as a payment system. As a foreigner, you have access to this too—unlike WeChat Pay in China or Juice in Mauritius, for which you need a local bank account. So, yay! This is fantastic! But how do you use it?

First of all, you need to know that there are actually two accounts: your calling credit account is different from your mobile money account. I covered the calling credit in the Malagasy SIM card article, so I won’t cover this here. The easiest way to recognize where your money is is by checking it in the respective mobile money app you can download onto your smartphone. Once you know it’s the right type of account, you can proceed.

MVola by Telma

MVola app: download Google Play + Apple App Store

You can load money onto your MVola account by debit/credit card (MasterCard). Just go to this link on the MVola website and sign up for an account. If you’ve ever made an online purchase by debit/credit card, you should be confident to follow the next steps to load balance on your MVola account.

There’s a 2.5% surcharge to load it with a credit card. That fee doesn’t exist when you load it with cash, but I think* that defeats the purpose of using a mobile money service. The fee to send money is roughly 0.3%. If businesses or people want to get the money you sent out in cash, their withdrawal fee is about 1%. Most businesses want you to cover their 1% withdrawal fee, which we find a bit petty.

Now that you have money on your MVola, you can send it to people. You simply go to the app and select transfer & paiement ➔ type in their phone number, the amount in Ariary, and a description (just type something) ➔ press confirm and type in your secret code (which is 0000 unless you changed this). Tricky thing: you can’t wait too long or the transaction times out and you’ll have to start again. When everything goes right, both parties receive a confirmation text on their phones. Keep this text as your receipt. You can offer people to take a photo of your text for their comfort that they got paid.

Orange Money by Orange

Orange Money Africa App: Google Play + Apple App Store

You can load money onto your Orange Money account by credit card (MasterCard only). Just go to this link on the Orange Money website. You don’t have to sign up for an account here first because you already have one with your phone number. But, annoyingly so, you have to type in your passport number every time you use it. If you’ve ever made an online purchase by debit/credit card, you should be confident to follow the next steps to load balance on your Orange Money account.

There’s a 1% surcharge to load money with a debit/credit card. It’s about 0.2% to send money from one Orange Money account to another. The Orange Money to cash withdrawal fee for the person you sent it to is about 1%, which again most people and businesses will want you to cover, which we again find a bit petty to make that our problem.

Sending money to another Orange Money account works exactly the same as with MVola. The secret code default is also 0000 unless you changed it. The app is actually a bit nicer to use. What’s extra nice is that the Orange Money app is partially in English.

Airtel Money by Airtel

I won’t cover Airtel Money in this article because I don’t have any experience with it. But Airtel Money is also the least represented form, whereas MVola is the most popular one followed quickly by Orange Money.

The general Airtel app is pretty neat for checking how much data I’ve used, but unfortunately, this SIM card was so hard to get that the people who sold us the SIM card couldn’t get us signed up for Airtel Money. Something with a poor connection. Either way, having two out of three mobile money services in Madagascar was good enough to travel around for months.

Why not send money by credit card directly to another person?

Why not send money to another person’s MVola/Orange Money by credit card directly? Because most people aren’t very used to this technology yet and aren’t super comfortable using it. They mostly use mobile money services with USSD codes, so using the app to make the transaction is already a little out of the ordinary. Going any further off-script might save you 0.3% but people might find this anxiety-inducing. The familiarity of tech of the average John just isn’t there yet in Madagascar. Give it time and be patient with people!

Can I send money from Orange Money to MVola?

Yes, you can send money from one mobile money service to another. But, of course, the fee will be higher. If you have multiple SIM cards –which is what we recommend if you work online and are staying for months – just try to match the provider.

Any other questions? Leave a comment below

I hope I’ll find the answers to your money in Madagascar questions before I leave the country.

Thanks 🙏 Any advice on catching a taxi from Tana – Nosy Be ? 🙏

Hi Anthony, I really don’t like flying and generally don’t recommend it, but Madagascar is a special place. If you’re not traveling in a group, the taxi from Tana to Ankify (where the ferry to Nosy Be departs from) will be much more expensive and take longer than a flight. Traveling by land would probably take more than two days. If traveling in the rainy season, it’s even longer.

Comment envoyer de l’argent à Madagascar via juice en smartphone ?

Je sais pas si c’est possible avec juice, mais si tu a une carte bancaire de type MasterCard, tu peux utiliser le service de MVola (https://cb2.mvola.mg/transaction/new) ou OrangeMoney (https://approcarte.orange.mg/) pour envoyer de l’argent à Madagascar.

Hi Iris,

I really appreciate this article, it was EXTREMELY helpful, as I am in Madagascar right now and have been trying to figure out how to add money to my MVola or Orange Money account. Actually I was just trying to buy more data for my Telma and Orange SIM cards and I couldn’t figure out how to do it with a debit/credit card and of course no one here could help me, LOL. That is when I started researching and found out about the mobile payment services. Your article has connecting all the pieces so I REALLY appreciate it.

The only part in the article I did not fully understand was this:

“no reasonable Malagasy has that kind of money in their MVola account ready to send to the nearest vazaha (you). And though MVola has loans in the app, eh, maybe don’t put people into debt? Just use your credit card.”

Are you saying that the MVola agent needs to have money (the 800,000 in question) in his/her account to be able to send to me and then they will get the money reimbursed after they deposit the money I gave them into their account?

How would I be putting someone into debt by asking the MVola agent to load 800,000 Ariary into my MVola account? I just wasn’t quite clear on that. Since I see the MVola agent booths set up a lot around town (Mananjary, Manakara etc.) I figure it would be easy to give the agent the cash.

But also when I think about getting the money out of the ATM (which there is a fee) to take to the MVola agent… I guess you pay fees either way.

Hey Elliot,

Great to hear that my article is helpful for you.

Yes, they need to have the 800,000 in their account and then deposit your cash back into their account afterwards. They might be able to take out a loan if they don’t have enough in their account.

Don’t worry, you’re not really putting people into debt because they have your cash to immediately pay back the loan. I just think taking out loans is a terrible habit and can only imagine the outrageous interest rates.

Yes, you’ll end up paying quite some fees either way. We found just doing it online from the comfort and safety of your hotel (and maybe even collect some credit card points on the way) is by far the superior method.

Enjoy your time in Madagascar!